“Financial Integrity is achieved by learning the true impact of your earning and spending both on your family and on the planet. ”

I just finished the book "Your Money or Your Life" by Vicki Robin and Joe Dominquez. I love personal finance and am an avid personal finance book reader. I write about personal finance over at Sisters for Financial Independence. Of all of the books I've read, this is one of the few books that talk about the relationship and impact of our spending on both our wallets and on our one planet. I recommend checking it out. It was just re-released, but you can still get the old copy at your local library.

Your Money or Your Life: Financial integrity.

Your Money or Your Life: Ethic of sustainability

The Fulfillment Curve

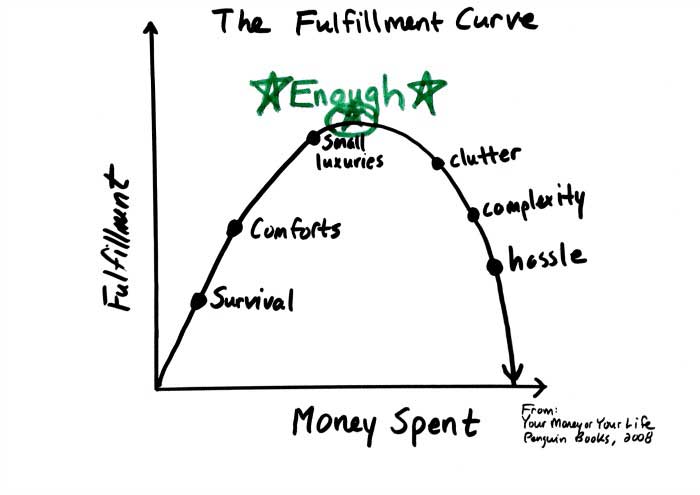

Early in the book, the authors cover the Fulfillment Curve. It's about really understanding your needs versus wants. For many of us in the world, our basic needs have already been met. As we move along the curve, many of us are also living in comfort. A good few of us have the small luxuries in place as well. The problem and challenge is that for another majority, we live in excess, always wanting more, sacrificing our time and money for the next best thing that we end up living in clutter, complexity and hassle as detailed in the graph below.

We truly have to understand what our Enough point is. Everything else after that point is excess and it is hurting our wallet and the planet. Perhaps, many of us don't realize this because we are always looking at our neighbor's green grass, but if we look into our own, we would realize that our own grass is as great, maybe abundant and may need our TLC.

We sometimes get scared of the Enough point because it can mean deprivation, but we don't live in a world of scarcity. We live in an over abundant world and the Enough point is defined by you. The Enough point is also a wide space for you to figure out what works and what doesn't.

The Fulfillment Curve from "Your Money or Your Life". Image from biggerpockets.com

“It is knowing what is enough money and natural goods to keep you at the peak of fulfillment - what is just excess and clutter.”

Your Money or Your Life: The stuff you buy is correlated with your impact on nature.

Your Money or Your Life: Waste lies in the failure to enjoy your possessions.

Stuff = Money = Time

What many of us fail to realize is that all of the stuff around us was once money and money was once time. Our greatest asset is time and we readily sell to get the next new and shiny thing. What this means is that we are literally working to just consume. We are taught that we must earn and accumulate now and enjoy it later in retirement. We are taught that to be a good citizen, we must spend and be good consumers. We are taught that shopping and retail therapy will earn us happiness, boost our ego and make us look better. The reality is that it doesn't. Instead, we sacrifice our hours, putting in more time at work and instead relegate the important things like childcare to other people or pay others to clean the houses that we barely have time to enjoy. Our compass appears to be broken.

Stuff and the Environment

“The environment is not just an external resource for an ever expanding economy but rather vice-versa, the economy is a human invention that operates within the limited capacity of the biosphere to provide the basic services of life. In the beginning, the economy tapped into the environment, now it’s draining it dry.”

What we fail to see also as we are draining our wallets to buy things we don't need to impress people we don't like is that we are also destroying our one Earth. It is our consumption that is harming the environment. The constant need and extraction of resources to replace goods that are still in functioning condition. This is where our need for stuff is squeezing the Earth.

“The Earth’s generative capacity can no longer keep up with the demand - people are turning resources into waste faster than nature nature can turn waste back into resources. We don’t get more planet later. ”

This is why it's important that we think about the waste that we generate. It's not just stuff, but time that is wasted. We put in our time to objects and that object gets tossed so quickly. With that disposal is also the disposal of someone's hard work to make that product and our personal hard work to earn the money to buy that product. How many meetings we had to sit through? How many frustrating emails did we have to deal with? Whose recitals did we have to miss? How many soccer games did we show up late to? We've forgotten what to value and we need to take a step back.

Your Money or Your Life

The rest of the book covers the steps needed to transform your relationship with money and achieving financial independence. I won't cover those in here as I will write a separate post over at Sisters for FI on that, but I do recommend picking up this book at your local library. The concepts are pretty straightforward and for someone already trying to live a sustainable life, I think it makes sense to pursue it further and connect it with the idea of financial independence. Financial independence is achievable for all of us. Retirement is about financial independence, but my personal goal is to retire when I have the income, not because of my age. We also have to re-think retirement. I won't be sitting around in retirement, but I want to be doing what I want to do that has more impact in the world. For many of us living a zero waste, low impact or low waste lifestyle, we've already recognize the need to change our lifestyles and if you have not yet, re-consider adopting a new lifestyle to #SaveMoneySaveThePlanet.

Ready to see the impact of your

consumption on the planet,

sign-up for the 15 day

#SaveMoneySaveThePlanet Project.